There’s a question that comes up again and again in the TV industry. It’s a question that many executives think they already know the answer to. Based on a survey of one, sometimes two, of their own kids they believe they have seen the future of TV viewing. Then there is another group of naysayers, who point out that how we behave as a child, bears little resemblance to how we behave as an adult. Much of the debate, of course, has centered on the infamous Millennials.

So who’s right? Today we find ourselves in a position where the oldest Millennials are approaching middle age. Soon they will be hitting and passing 35. So what can we now learn about continuing behavior from childhood into middle age?

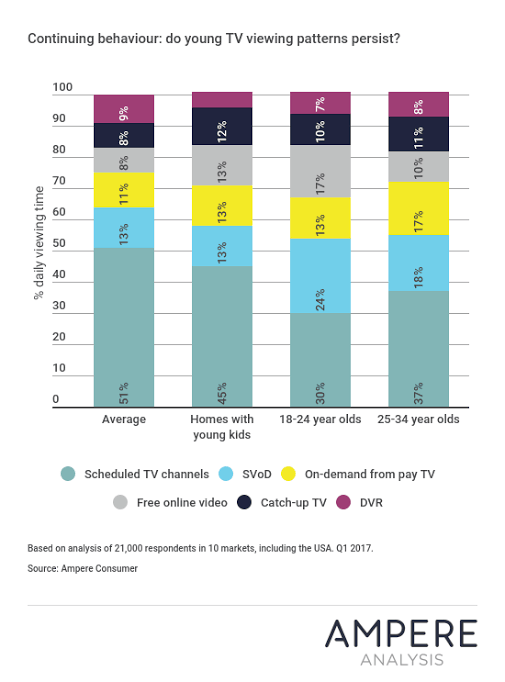

We find ourselves in a position to look at viewing behavior differences between young Millennials (18-24) and older Millennials (25-34). Yes, there are inevitable age-related differences, but they all fall into the same demographic grouping. We can also look at homes with young kids (effectively Millennials with a resident Gen Z-er).

Finally, then, we may be able to answer the eternal question about continuation of TV viewing behavior. In a way, what we are looking at is the progression of child-influenced viewing behavior, into the teens, 20s and 30s…albeit from the same point in time.

For homes with kids, the key variance from average behavior is in use of free online video and through much more use of catch-up and a little more SVoD. In other words, there is an increasing move towards time-shifting and non-linear.

Moving to the 18-24 year olds, it’s linear TV viewing that drops off considerably, free online becomes key and SVoD ascends significantly. Adoption of non-linear and rejection of linear is clearly in full-swing. But looking at the 25-35 age category (our near-Middle age Millennials), behavior starts to shift back to scheduled TV and linear. SVoD remains a significant part of the viewing day for this age group, but free online video drops away noticeably; catch-up and DVR usage stabilise in line with the younger Millennials and a portion of on-demand viewing shits back to ‘traditional’ TV in the form of pay TV operator on-demand.

So, perhaps, both groups of executives have a point. Youthful non-linear patterns persists, but it is not a case of a complete and permanent shift. The weight of adulthood and middle-age bring some of the more traditional viewing patterns back to the fore.